Filed by Innoviz Technologies Ltd.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Collective Growth Corporation

Commission File No.: 001-39276

Date: February 18, 2021

Enabling the Autonomous Vehicle Revolution Analyst Day February 2021 1 1 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Enabling the Autonomous Vehicle Revolution Analyst Day February 2021 1 1 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Disclaimer This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Innoviz Technologies Ltd. (“the “Company” or “Innoviz”) and Collective Growth Corporation (“Collective Growth”) and related transactions (the “Proposed Business Combination”) and for no other purpose. No representations or warranties, express or implied are given in, or respect of, this Presentation. To the fullest extent permitted by law, in no circumstances will Innoviz, Collective Growth, Antara Capital LP or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. This Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Innoviz or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of Innoviz and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward-Looking Statements This Presentation contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Innoviz and Collective Growth, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Innoviz and the markets in which it operates, and Innoviz’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Collective Growth’s securities, (ii) the risk that the transaction may not be completed by Collective Growth’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Collective Growth, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the business combination agreement by the shareholders of Collective Growth and Innoviz, the satisfaction of the minimum trust account amount following redemptions by Collective Growth’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, (vi) the effect of the announcement or pendency of the transaction on Innoviz’s business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans of Innoviz and potential difficulties in Innoviz employee retention as a result of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Innoviz or against Collective Growth related to the business combination agreement or the proposed transaction, (ix) the ability of Innoviz to list its ordinary shares on the Nasdaq, (x) the price of Innoviz’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Innoviz plans to operate, variations in performance across competitors, changes in laws and regulations affecting Innoviz’s business and changes in the combined capital structure, and (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Collective Growth’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and other documents filed by Collective Growth from time to time with the U.S. Securities and Exchange Commission (the “SEC”) and the registration statement on Form F-4 and proxy statement/prospectus discussed below. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Innoviz and Collective Growth assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Innoviz nor Collective Growth gives any assurance that either Innoviz or Collective Growth will achieve its expectations. Additional Information and Where to Find It This Presentation relates to a proposed transaction between Innoviz and Collective Growth. This Presentation does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Innoviz intends to file a registration statement on Form F-4 that will include a proxy statement of Collective Growth and a prospectus of Innoviz. The proxy statement/prospectus will be sent to all Collective Growth stockholders. Collective Growth and Innoviz also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Collective Growth are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Collective Growth or Innoviz through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Collective Growth may be obtained free of charge from Collective Growth’s website at www.collectivegrowthcorp.com or by written request to Collective Growth at Collective Growth Corporation, 1805 West Avenue, Austin, TX 78701 and the documents filed by Innoviz may be obtained free of charge from Innoviz’s website at www.innoviz.tech or by written request to Innoviz at Innoviz Technologies Ltd., 2 Amal Street, Rosh HaAin, 4809202, Israel. 2 2 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Disclaimer This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Innoviz Technologies Ltd. (“the “Company” or “Innoviz”) and Collective Growth Corporation (“Collective Growth”) and related transactions (the “Proposed Business Combination”) and for no other purpose. No representations or warranties, express or implied are given in, or respect of, this Presentation. To the fullest extent permitted by law, in no circumstances will Innoviz, Collective Growth, Antara Capital LP or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. This Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Innoviz or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of Innoviz and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward-Looking Statements This Presentation contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Innoviz and Collective Growth, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Innoviz and the markets in which it operates, and Innoviz’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Collective Growth’s securities, (ii) the risk that the transaction may not be completed by Collective Growth’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Collective Growth, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the business combination agreement by the shareholders of Collective Growth and Innoviz, the satisfaction of the minimum trust account amount following redemptions by Collective Growth’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, (vi) the effect of the announcement or pendency of the transaction on Innoviz’s business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans of Innoviz and potential difficulties in Innoviz employee retention as a result of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Innoviz or against Collective Growth related to the business combination agreement or the proposed transaction, (ix) the ability of Innoviz to list its ordinary shares on the Nasdaq, (x) the price of Innoviz’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Innoviz plans to operate, variations in performance across competitors, changes in laws and regulations affecting Innoviz’s business and changes in the combined capital structure, and (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Collective Growth’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and other documents filed by Collective Growth from time to time with the U.S. Securities and Exchange Commission (the “SEC”) and the registration statement on Form F-4 and proxy statement/prospectus discussed below. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Innoviz and Collective Growth assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Innoviz nor Collective Growth gives any assurance that either Innoviz or Collective Growth will achieve its expectations. Additional Information and Where to Find It This Presentation relates to a proposed transaction between Innoviz and Collective Growth. This Presentation does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Innoviz intends to file a registration statement on Form F-4 that will include a proxy statement of Collective Growth and a prospectus of Innoviz. The proxy statement/prospectus will be sent to all Collective Growth stockholders. Collective Growth and Innoviz also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Collective Growth are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Collective Growth or Innoviz through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Collective Growth may be obtained free of charge from Collective Growth’s website at www.collectivegrowthcorp.com or by written request to Collective Growth at Collective Growth Corporation, 1805 West Avenue, Austin, TX 78701 and the documents filed by Innoviz may be obtained free of charge from Innoviz’s website at www.innoviz.tech or by written request to Innoviz at Innoviz Technologies Ltd., 2 Amal Street, Rosh HaAin, 4809202, Israel. 2 2 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Disclaimer Participants in Solicitation Collective Growth and Innoviz and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Collective Growth’s stockholders in connection with the proposed transaction. Information about Collective Growth’s directors and executive officers and their ownership of Collective Growth’s securities is set forth in Collective Growth’s filings with the SEC, including Collective Growth’s final prospectus filed with the SEC on May 1, 2020. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction. You may obtain a free copy of these documents as described in the preceding paragraph. Industry and Market Data This presentation has been prepared by Innoviz and Collective Growth and includes market data and other statistical information from sources believed by Innoviz and Collective to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Innoviz or Collective Growth, which in each case are derived from its review of internal sources as well as the independent sources described above. Although Innoviz and Collective Growth believe these sources are reliable, Innoviz and Collective Growth have not independently verified the information and cannot guarantee its accuracy and completeness. Antara Capital LP has not made any verification of the market data and other statistical information included in this presentation. Financial Information; Non-GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in the registration statement to be filed by Innoviz with the SEC and the proxy statement/prospectus contained therein. Some of the financial information and data contained in this Presentation, such as EBITDA and free cash flow, has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Innoviz and Collective Growth believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Innoviz’s financial condition and results of operations. Innoviz’s management uses these non-GAAP measure for trend analyses and for budgeting and planning purposes. Innoviz and Collective Growth believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in comparing Innoviz’s financial condition and results of operations with other similar companies, many of which present similar nonGAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Innoviz’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded and included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. You should review Innoviz’s audited financial statements, which will be included in the registration statement. No Offer or Solicitation This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended. Use of Projections Any financial information or projections in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Innoviz’s and Collective Growth’s control. While such information and projections are necessarily speculative, Innoviz and Collective Growth believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of financial information or projections in this Presentation should not be regarded as an indication that Innoviz or Collective Growth, or their respective representatives and advisors, considered or consider the information or projections to be a reliable prediction of future events. This Presentation is not intended to be all-inclusive or to contain all the information that a person may desire in considering in an investment in Innoviz or Collective Growth and is not intended to form the basis of an investment decision in either company. All subsequent written and oral forward-looking statements concerning Innoviz and Collective Growth, the proposed transactions or other matters and attributable to Innoviz and Collective Growth or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Trademarks This Presentation contains trademarks, service marks, trade names and copyrights of Innoviz, Collective Growth and other companies, which are the property of their respective owners. 3 3 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Disclaimer Participants in Solicitation Collective Growth and Innoviz and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Collective Growth’s stockholders in connection with the proposed transaction. Information about Collective Growth’s directors and executive officers and their ownership of Collective Growth’s securities is set forth in Collective Growth’s filings with the SEC, including Collective Growth’s final prospectus filed with the SEC on May 1, 2020. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction. You may obtain a free copy of these documents as described in the preceding paragraph. Industry and Market Data This presentation has been prepared by Innoviz and Collective Growth and includes market data and other statistical information from sources believed by Innoviz and Collective to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Innoviz or Collective Growth, which in each case are derived from its review of internal sources as well as the independent sources described above. Although Innoviz and Collective Growth believe these sources are reliable, Innoviz and Collective Growth have not independently verified the information and cannot guarantee its accuracy and completeness. Antara Capital LP has not made any verification of the market data and other statistical information included in this presentation. Financial Information; Non-GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in the registration statement to be filed by Innoviz with the SEC and the proxy statement/prospectus contained therein. Some of the financial information and data contained in this Presentation, such as EBITDA and free cash flow, has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Innoviz and Collective Growth believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Innoviz’s financial condition and results of operations. Innoviz’s management uses these non-GAAP measure for trend analyses and for budgeting and planning purposes. Innoviz and Collective Growth believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in comparing Innoviz’s financial condition and results of operations with other similar companies, many of which present similar nonGAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Innoviz’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded and included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. You should review Innoviz’s audited financial statements, which will be included in the registration statement. No Offer or Solicitation This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended. Use of Projections Any financial information or projections in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Innoviz’s and Collective Growth’s control. While such information and projections are necessarily speculative, Innoviz and Collective Growth believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of financial information or projections in this Presentation should not be regarded as an indication that Innoviz or Collective Growth, or their respective representatives and advisors, considered or consider the information or projections to be a reliable prediction of future events. This Presentation is not intended to be all-inclusive or to contain all the information that a person may desire in considering in an investment in Innoviz or Collective Growth and is not intended to form the basis of an investment decision in either company. All subsequent written and oral forward-looking statements concerning Innoviz and Collective Growth, the proposed transactions or other matters and attributable to Innoviz and Collective Growth or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Trademarks This Presentation contains trademarks, service marks, trade names and copyrights of Innoviz, Collective Growth and other companies, which are the property of their respective owners. 3 3 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Company OverviewCompany Overview

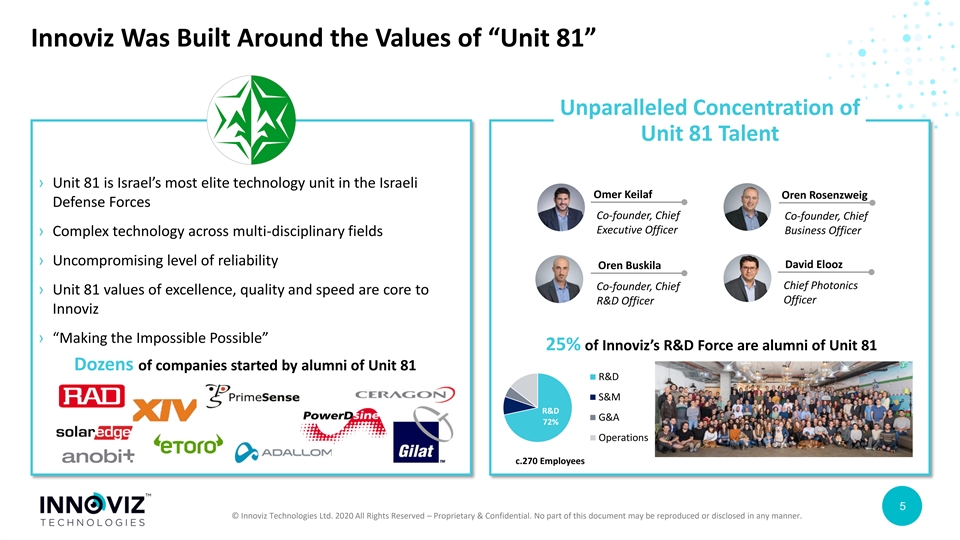

Innoviz Was Built Around the Values of “Unit 81” Unparalleled Concentration of Unit 81 Talent › Unit 81 is Israel’s most elite technology unit in the Israeli Omer Keilaf Oren Rosenzweig Defense Forces Co-founder, Chief Co-founder, Chief Executive Officer Business Officer › Complex technology across multi-disciplinary fields › Uncompromising level of reliability David Elooz Oren Buskila Chief Photonics Co-founder, Chief › Unit 81 values of excellence, quality and speed are core to Officer R&D Officer Innoviz › “Making the Impossible Possible” 25% of Innoviz’s R&D Force are alumni of Unit 81 Dozens of companies started by alumni of Unit 81 R&D S&M R&D G&A 72% Operations c.270 Employees 5 5 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Was Built Around the Values of “Unit 81” Unparalleled Concentration of Unit 81 Talent › Unit 81 is Israel’s most elite technology unit in the Israeli Omer Keilaf Oren Rosenzweig Defense Forces Co-founder, Chief Co-founder, Chief Executive Officer Business Officer › Complex technology across multi-disciplinary fields › Uncompromising level of reliability David Elooz Oren Buskila Chief Photonics Co-founder, Chief › Unit 81 values of excellence, quality and speed are core to Officer R&D Officer Innoviz › “Making the Impossible Possible” 25% of Innoviz’s R&D Force are alumni of Unit 81 Dozens of companies started by alumni of Unit 81 R&D S&M R&D G&A 72% Operations c.270 Employees 5 5 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

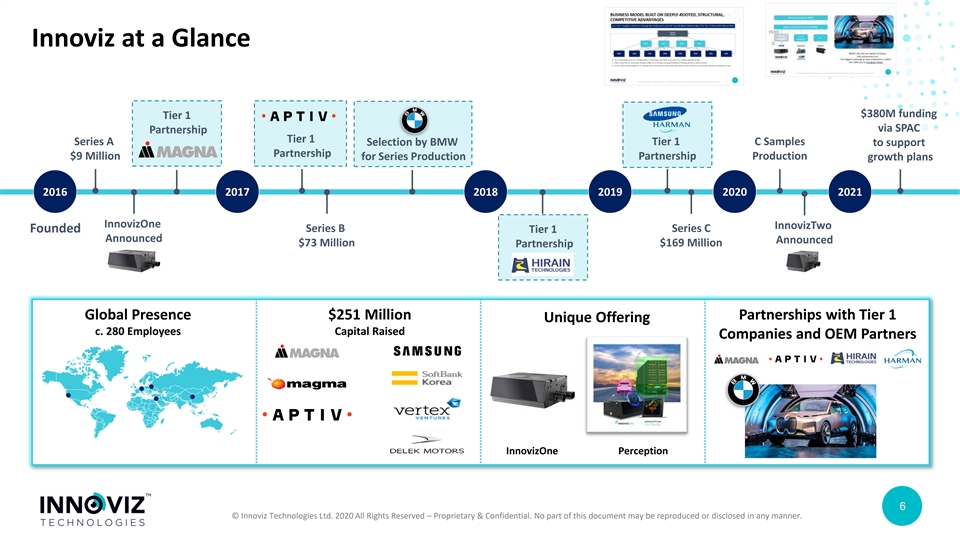

Innoviz at a Glance $380M funding Tier 1 via SPAC Partnership Tier 1 Series A Tier 1 C Samples Selection by BMW to support Partnership $9 Million for Series Production Partnership Production growth plans 2016 2017 2018 2019 2020 2021 InnovizOne InnovizTwo Series B Series C Founded Tier 1 Announced Announced $73 Million $169 Million Partnership Global Presence $251 Million Partnerships with Tier 1 Unique Offering c. 280 Employees Capital Raised Companies and OEM Partners InnovizOne Perception 6 6 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz at a Glance $380M funding Tier 1 via SPAC Partnership Tier 1 Series A Tier 1 C Samples Selection by BMW to support Partnership $9 Million for Series Production Partnership Production growth plans 2016 2017 2018 2019 2020 2021 InnovizOne InnovizTwo Series B Series C Founded Tier 1 Announced Announced $73 Million $169 Million Partnership Global Presence $251 Million Partnerships with Tier 1 Unique Offering c. 280 Employees Capital Raised Companies and OEM Partners InnovizOne Perception 6 6 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

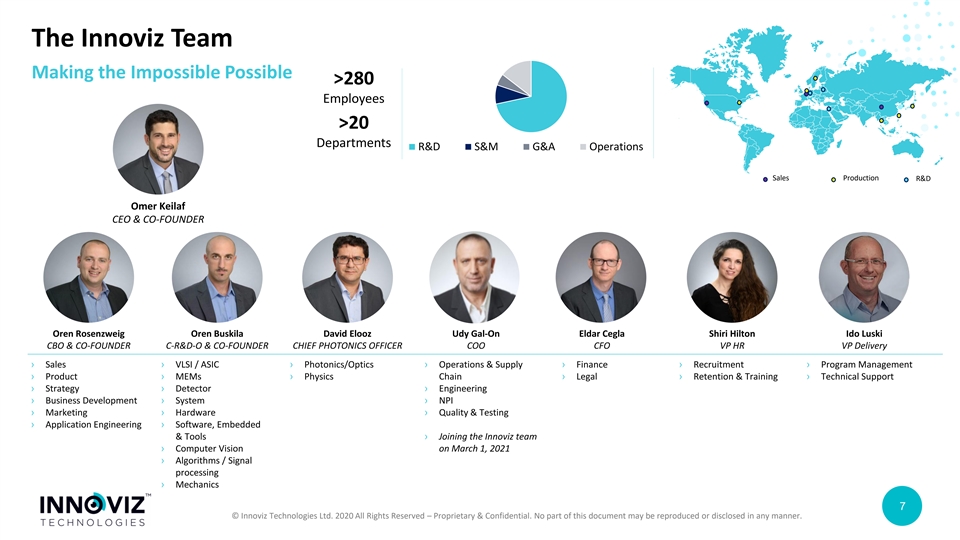

The Innoviz Team Making the Impossible Possible >280 Employees >20 Departments R&D S&M G&A Operations Sales Production R&D Omer Keilaf CEO & CO-FOUNDER Oren Rosenzweig Oren Buskila David Elooz Udy Gal-On Eldar Cegla Shiri Hilton Ido Luski CBO & CO-FOUNDER C-R&D-O & CO-FOUNDER CHIEF PHOTONICS OFFICER COO CFO VP HR VP Delivery › Sales› VLSI / ASIC› Photonics/Optics› Operations & Supply› Finance› Recruitment› Program Management › Product › MEMs› Physics Chain› Legal› Retention & Training› Technical Support › Strategy› Detector› Engineering › Business Development› System› NPI › Marketing› Hardware› Quality & Testing › Application Engineering› Software, Embedded & Tools› Joining the Innoviz team › Computer Vision on March 1, 2021 › Algorithms / Signal processing › Mechanics 7 7 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.The Innoviz Team Making the Impossible Possible >280 Employees >20 Departments R&D S&M G&A Operations Sales Production R&D Omer Keilaf CEO & CO-FOUNDER Oren Rosenzweig Oren Buskila David Elooz Udy Gal-On Eldar Cegla Shiri Hilton Ido Luski CBO & CO-FOUNDER C-R&D-O & CO-FOUNDER CHIEF PHOTONICS OFFICER COO CFO VP HR VP Delivery › Sales› VLSI / ASIC› Photonics/Optics› Operations & Supply› Finance› Recruitment› Program Management › Product › MEMs› Physics Chain› Legal› Retention & Training› Technical Support › Strategy› Detector› Engineering › Business Development› System› NPI › Marketing› Hardware› Quality & Testing › Application Engineering› Software, Embedded & Tools› Joining the Innoviz team › Computer Vision on March 1, 2021 › Algorithms / Signal processing › Mechanics 7 7 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

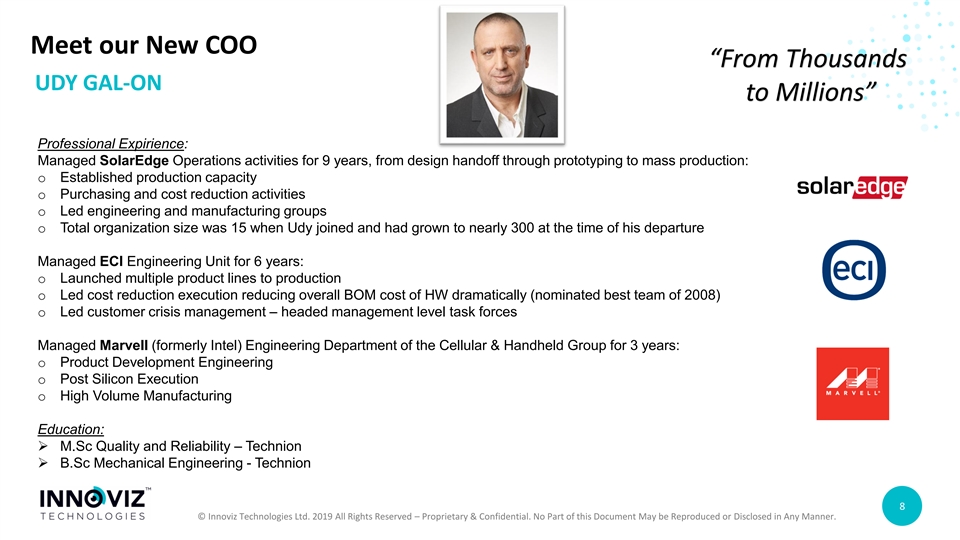

Meet our New COO “From Thousands UDY GAL-ON to Millions” Professional Expirience: Managed SolarEdge Operations activities for 9 years, from design handoff through prototyping to mass production: o Established production capacity o Purchasing and cost reduction activities o Led engineering and manufacturing groups o Total organization size was 15 when Udy joined and had grown to nearly 300 at the time of his departure Managed ECI Engineering Unit for 6 years: o Launched multiple product lines to production o Led cost reduction execution reducing overall BOM cost of HW dramatically (nominated best team of 2008) o Led customer crisis management – headed management level task forces Managed Marvell (formerly Intel) Engineering Department of the Cellular & Handheld Group for 3 years: o Product Development Engineering o Post Silicon Execution o High Volume Manufacturing Education: ➢ M.Sc Quality and Reliability – Technion ➢ B.Sc Mechanical Engineering - Technion 8 © Innoviz Technologies Ltd. 2019 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.Meet our New COO “From Thousands UDY GAL-ON to Millions” Professional Expirience: Managed SolarEdge Operations activities for 9 years, from design handoff through prototyping to mass production: o Established production capacity o Purchasing and cost reduction activities o Led engineering and manufacturing groups o Total organization size was 15 when Udy joined and had grown to nearly 300 at the time of his departure Managed ECI Engineering Unit for 6 years: o Launched multiple product lines to production o Led cost reduction execution reducing overall BOM cost of HW dramatically (nominated best team of 2008) o Led customer crisis management – headed management level task forces Managed Marvell (formerly Intel) Engineering Department of the Cellular & Handheld Group for 3 years: o Product Development Engineering o Post Silicon Execution o High Volume Manufacturing Education: ➢ M.Sc Quality and Reliability – Technion ➢ B.Sc Mechanical Engineering - Technion 8 © Innoviz Technologies Ltd. 2019 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.

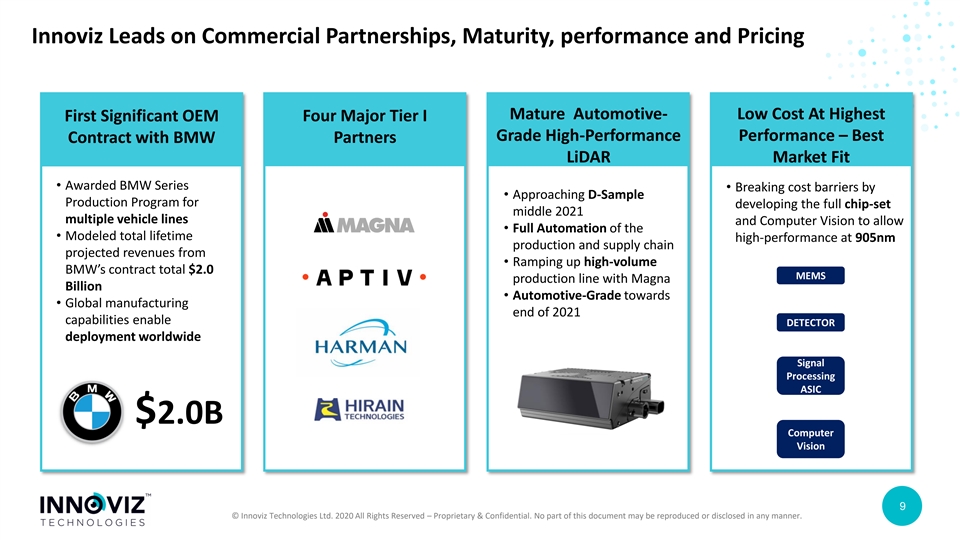

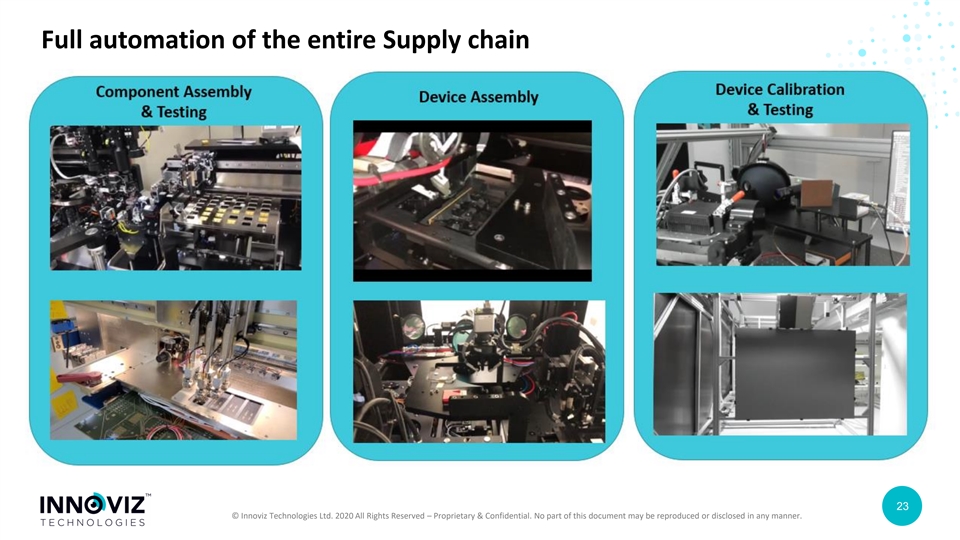

Innoviz Leads on Commercial Partnerships, Maturity, performance and Pricing Mature Automotive- Low Cost At Highest First Significant OEM Four Major Tier I Grade High-Performance Performance – Best Contract with BMW Partners LiDAR Market Fit • Awarded BMW Series • Breaking cost barriers by • Approaching D-Sample Production Program for developing the full chip-set middle 2021 multiple vehicle lines and Computer Vision to allow • Full Automation of the • Modeled total lifetime high-performance at 905nm production and supply chain projected revenues from • Ramping up high-volume BMW’s contract total $2.0 MEMS production line with Magna 55 Billion • Automotive-Grade towards • Global manufacturing end of 2021 capabilities enable DETECTOR deployment worldwide Signal Processing ASIC $2.0B Computer Vision 9 9 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Leads on Commercial Partnerships, Maturity, performance and Pricing Mature Automotive- Low Cost At Highest First Significant OEM Four Major Tier I Grade High-Performance Performance – Best Contract with BMW Partners LiDAR Market Fit • Awarded BMW Series • Breaking cost barriers by • Approaching D-Sample Production Program for developing the full chip-set middle 2021 multiple vehicle lines and Computer Vision to allow • Full Automation of the • Modeled total lifetime high-performance at 905nm production and supply chain projected revenues from • Ramping up high-volume BMW’s contract total $2.0 MEMS production line with Magna 55 Billion • Automotive-Grade towards • Global manufacturing end of 2021 capabilities enable DETECTOR deployment worldwide Signal Processing ASIC $2.0B Computer Vision 9 9 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

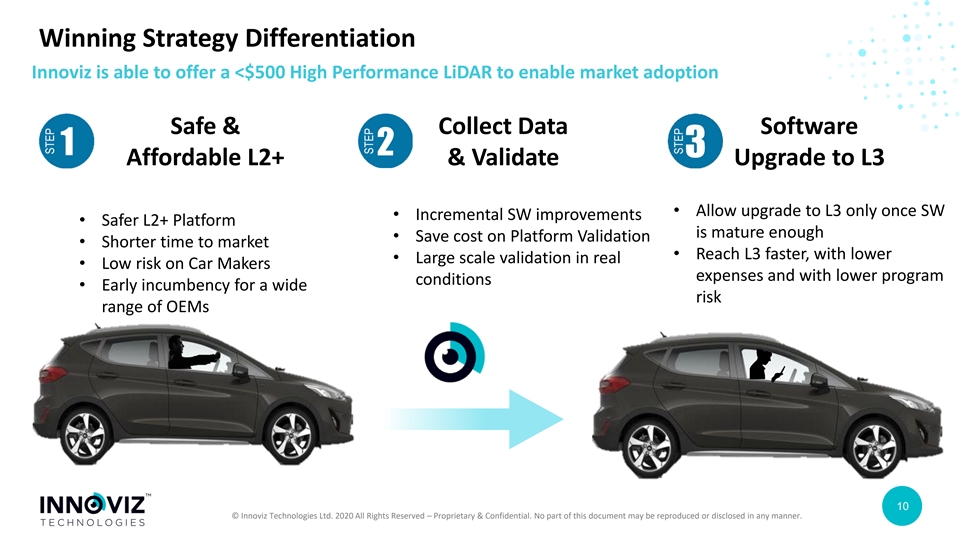

Winning Strategy Differentiation Innoviz is able to offer a <$500 High Performance LiDAR to enable market adoption Safe & Collect Data Software Affordable L2+ & Validate Upgrade to L3 • Allow upgrade to L3 only once SW • Incremental SW improvements • Safer L2+ Platform is mature enough • Save cost on Platform Validation • Shorter time to market • Reach L3 faster, with lower • Large scale validation in real • Low risk on Car Makers expenses and with lower program conditions • Early incumbency for a wide risk range of OEMs 10 10 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Winning Strategy Differentiation Innoviz is able to offer a <$500 High Performance LiDAR to enable market adoption Safe & Collect Data Software Affordable L2+ & Validate Upgrade to L3 • Allow upgrade to L3 only once SW • Incremental SW improvements • Safer L2+ Platform is mature enough • Save cost on Platform Validation • Shorter time to market • Reach L3 faster, with lower • Large scale validation in real • Low risk on Car Makers expenses and with lower program conditions • Early incumbency for a wide risk range of OEMs 10 10 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 11 11 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 11 11 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

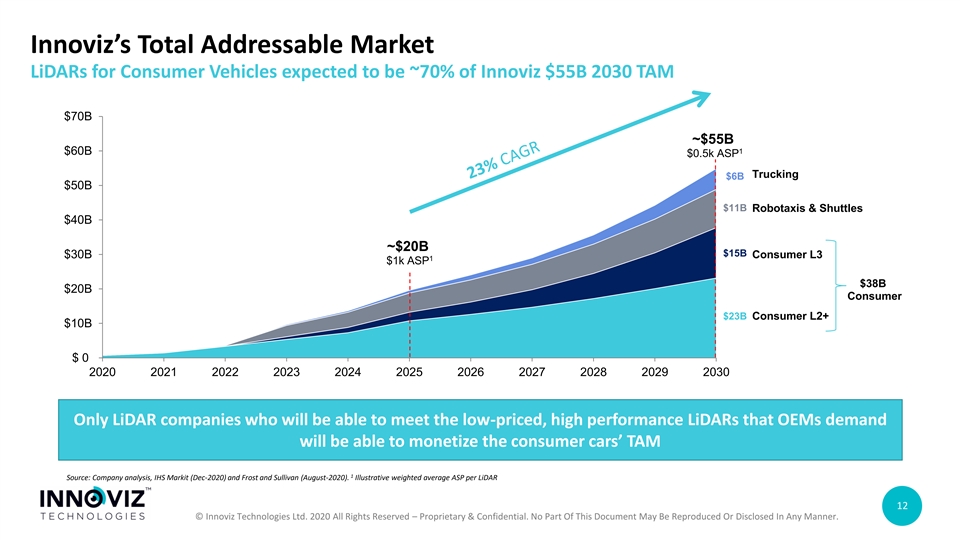

Innoviz’s Total Addressable Market LiDARs for Consumer Vehicles expected to be ~70% of Innoviz $55B 2030 TAM $70B ~$55B 1 $60B $0.5k ASP Trucking $6B $50B $11B Robotaxis & Shuttles $40B ~$20B $15B $30B Consumer L3 1 $1k ASP $38B $20B Consumer $23B Consumer L2+ $10B $ 0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Only LiDAR companies who will be able to meet the low-priced, high performance LiDARs that OEMs demand will be able to monetize the consumer cars’ TAM 1 Source: Company analysis, IHS Markit (Dec-2020) and Frost and Sullivan (August-2020). Illustrative weighted average ASP per LiDAR 12 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner.Innoviz’s Total Addressable Market LiDARs for Consumer Vehicles expected to be ~70% of Innoviz $55B 2030 TAM $70B ~$55B 1 $60B $0.5k ASP Trucking $6B $50B $11B Robotaxis & Shuttles $40B ~$20B $15B $30B Consumer L3 1 $1k ASP $38B $20B Consumer $23B Consumer L2+ $10B $ 0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Only LiDAR companies who will be able to meet the low-priced, high performance LiDARs that OEMs demand will be able to monetize the consumer cars’ TAM 1 Source: Company analysis, IHS Markit (Dec-2020) and Frost and Sullivan (August-2020). Illustrative weighted average ASP per LiDAR 12 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner.

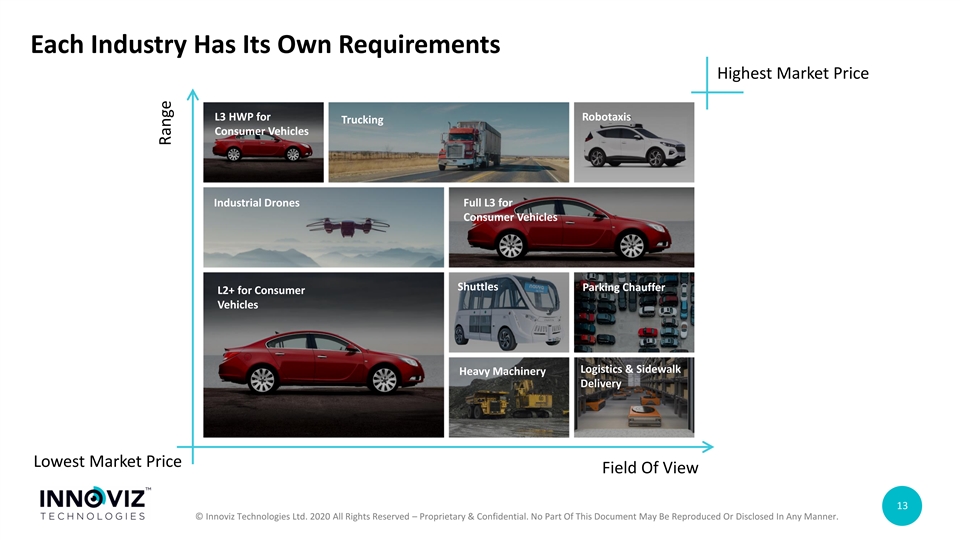

Each Industry Has Its Own Requirements Highest Market Price L3 HWP for Robotaxis Trucking Consumer Vehicles Industrial Drones Full L3 for Consumer Vehicles Shuttles Parking Chauffer L2+ for Consumer Vehicles Logistics & Sidewalk Heavy Machinery Delivery Lowest Market Price Field Of View 13 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner. RangeEach Industry Has Its Own Requirements Highest Market Price L3 HWP for Robotaxis Trucking Consumer Vehicles Industrial Drones Full L3 for Consumer Vehicles Shuttles Parking Chauffer L2+ for Consumer Vehicles Logistics & Sidewalk Heavy Machinery Delivery Lowest Market Price Field Of View 13 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner. Range

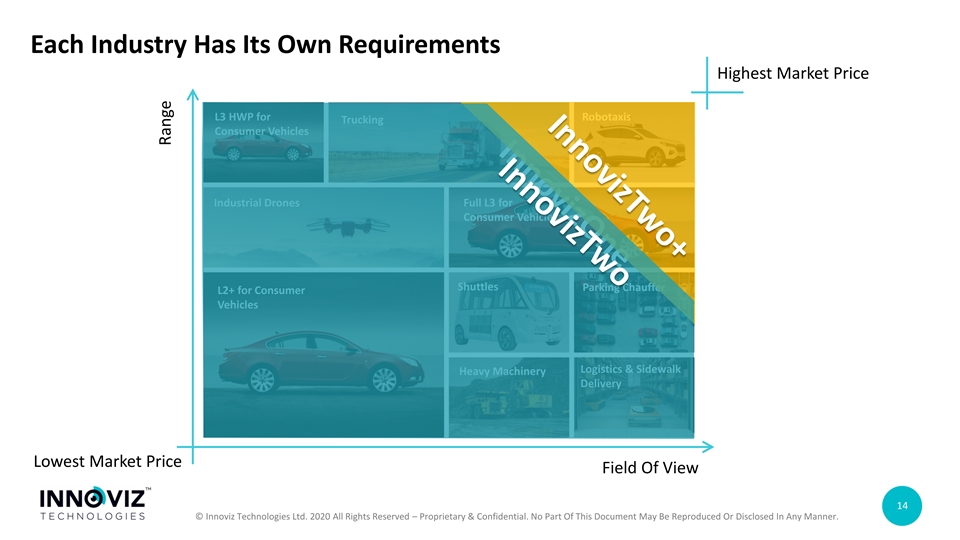

Each Industry Has Its Own Requirements Highest Market Price L3 HWP for Robotaxis Trucking Consumer Vehicles Industrial Drones Full L3 for Consumer Vehicles Shuttles Parking Chauffer L2+ for Consumer Vehicles Logistics & Sidewalk Heavy Machinery Delivery Lowest Market Price Field Of View 14 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner. RangeEach Industry Has Its Own Requirements Highest Market Price L3 HWP for Robotaxis Trucking Consumer Vehicles Industrial Drones Full L3 for Consumer Vehicles Shuttles Parking Chauffer L2+ for Consumer Vehicles Logistics & Sidewalk Heavy Machinery Delivery Lowest Market Price Field Of View 14 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner. Range

Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 15 15 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 15 15 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

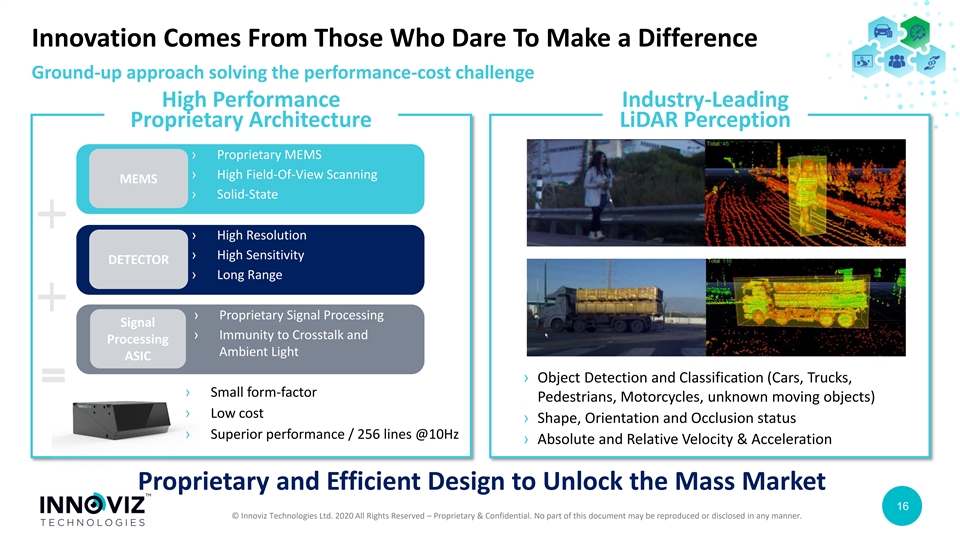

Innovation Comes From Those Who Dare To Make a Difference Ground-up approach solving the performance-cost challenge High Performance Industry-Leading Proprietary Architecture LiDAR Perception › Proprietary MEMS › High Field-Of-View Scanning MEMS › Solid-State › High Resolution › High Sensitivity DETECTOR › Long Range › Proprietary Signal Processing Signal › Immunity to Crosstalk and Processing Ambient Light ASIC › Object Detection and Classification (Cars, Trucks, › Small form-factor Pedestrians, Motorcycles, unknown moving objects) › Low cost › Shape, Orientation and Occlusion status › Superior performance / 256 lines @10Hz › Absolute and Relative Velocity & Acceleration Proprietary and Efficient Design to Unlock the Mass Market 16 16 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innovation Comes From Those Who Dare To Make a Difference Ground-up approach solving the performance-cost challenge High Performance Industry-Leading Proprietary Architecture LiDAR Perception › Proprietary MEMS › High Field-Of-View Scanning MEMS › Solid-State › High Resolution › High Sensitivity DETECTOR › Long Range › Proprietary Signal Processing Signal › Immunity to Crosstalk and Processing Ambient Light ASIC › Object Detection and Classification (Cars, Trucks, › Small form-factor Pedestrians, Motorcycles, unknown moving objects) › Low cost › Shape, Orientation and Occlusion status › Superior performance / 256 lines @10Hz › Absolute and Relative Velocity & Acceleration Proprietary and Efficient Design to Unlock the Mass Market 16 16 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

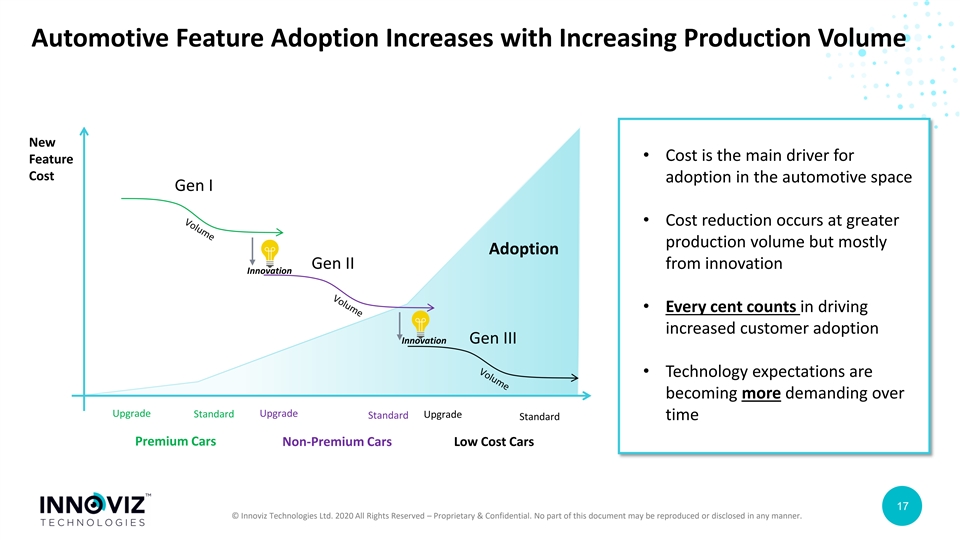

Automotive Feature Adoption Increases with Increasing Production Volume New • Cost is the main driver for Feature Cost adoption in the automotive space Gen I • Cost reduction occurs at greater production volume but mostly Adoption Gen II from innovation Innovation • Every cent counts in driving increased customer adoption Innovation Gen III • Technology expectations are becoming more demanding over Upgrade Standard Upgrade Upgrade Standard Standard time Premium Cars Non-Premium Cars Low Cost Cars 17 17 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Automotive Feature Adoption Increases with Increasing Production Volume New • Cost is the main driver for Feature Cost adoption in the automotive space Gen I • Cost reduction occurs at greater production volume but mostly Adoption Gen II from innovation Innovation • Every cent counts in driving increased customer adoption Innovation Gen III • Technology expectations are becoming more demanding over Upgrade Standard Upgrade Upgrade Standard Standard time Premium Cars Non-Premium Cars Low Cost Cars 17 17 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

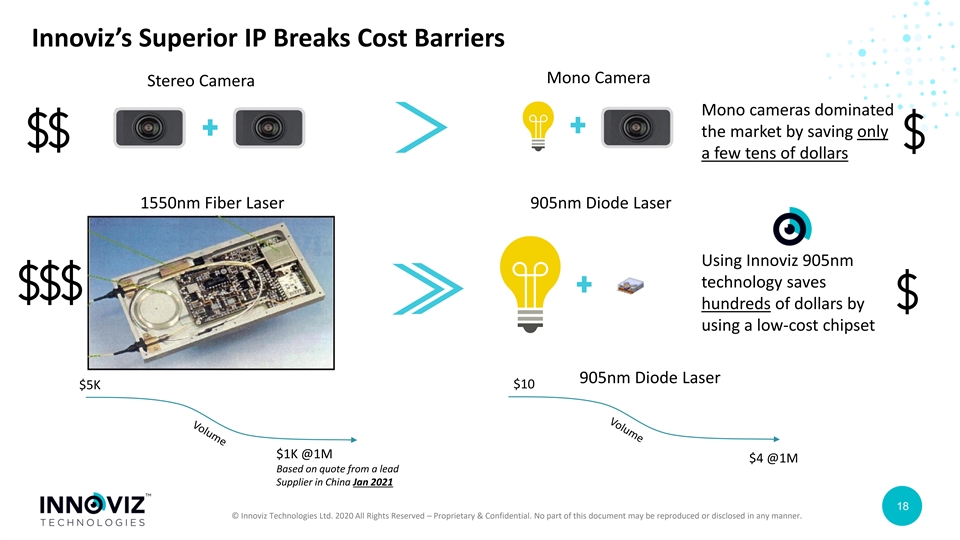

Innoviz’s Superior IP Breaks Cost Barriers Mono Camera Stereo Camera Mono cameras dominated the market by saving only a few tens of dollars 1550nm Fiber Laser 905nm Diode Laser Using Innoviz 905nm technology saves hundreds of dollars by using a low-cost chipset 905nm Diode Laser $10 $5K $1K @1M $4 @1M Based on quote from a lead Supplier in China Jan 2021 18 18 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz’s Superior IP Breaks Cost Barriers Mono Camera Stereo Camera Mono cameras dominated the market by saving only a few tens of dollars 1550nm Fiber Laser 905nm Diode Laser Using Innoviz 905nm technology saves hundreds of dollars by using a low-cost chipset 905nm Diode Laser $10 $5K $1K @1M $4 @1M Based on quote from a lead Supplier in China Jan 2021 18 18 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

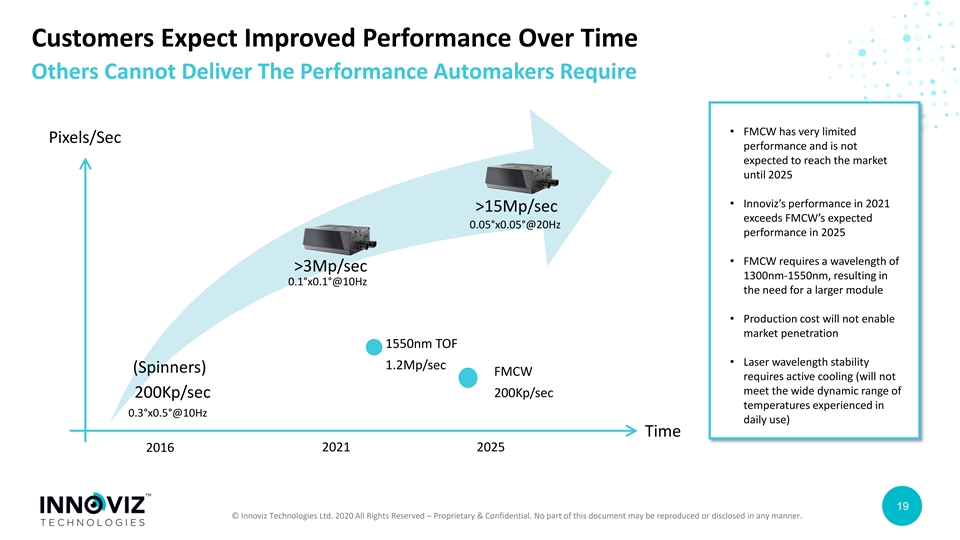

Customers Expect Improved Performance Over Time Others Cannot Deliver The Performance Automakers Require • FMCW has very limited Pixels/Sec performance and is not expected to reach the market until 2025 • Innoviz’s performance in 2021 >15Mp/sec exceeds FMCW’s expected 0.05°x0.05°@20Hz performance in 2025 • FMCW requires a wavelength of >3Mp/sec 1300nm-1550nm, resulting in 0.1°x0.1°@10Hz the need for a larger module • Production cost will not enable market penetration 1550nm TOF • Laser wavelength stability 1.2Mp/sec (Spinners) FMCW requires active cooling (will not meet the wide dynamic range of 200Kp/sec 200Kp/sec temperatures experienced in 0.3°x0.5°@10Hz daily use) Time 2021 2025 2016 19 19 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Customers Expect Improved Performance Over Time Others Cannot Deliver The Performance Automakers Require • FMCW has very limited Pixels/Sec performance and is not expected to reach the market until 2025 • Innoviz’s performance in 2021 >15Mp/sec exceeds FMCW’s expected 0.05°x0.05°@20Hz performance in 2025 • FMCW requires a wavelength of >3Mp/sec 1300nm-1550nm, resulting in 0.1°x0.1°@10Hz the need for a larger module • Production cost will not enable market penetration 1550nm TOF • Laser wavelength stability 1.2Mp/sec (Spinners) FMCW requires active cooling (will not meet the wide dynamic range of 200Kp/sec 200Kp/sec temperatures experienced in 0.3°x0.5°@10Hz daily use) Time 2021 2025 2016 19 19 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

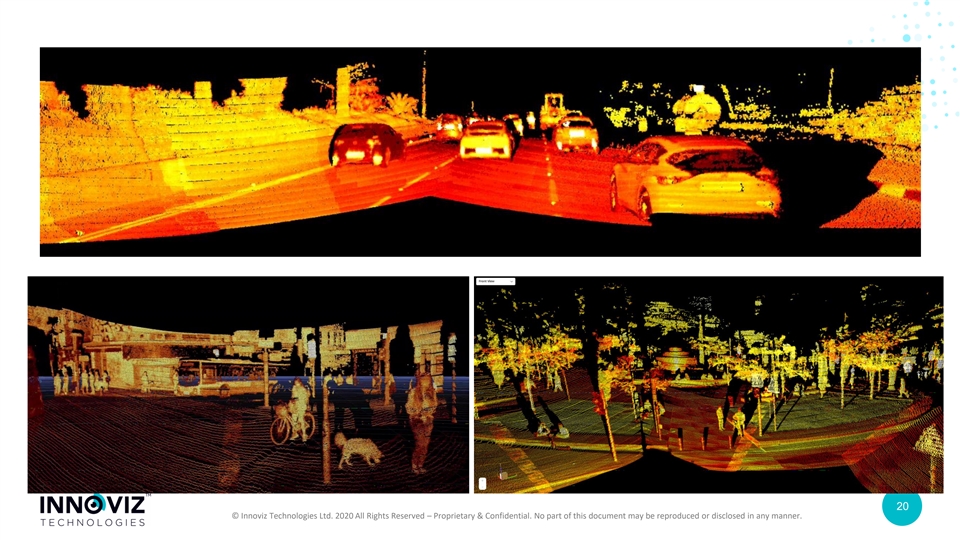

20 20 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.20 20 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

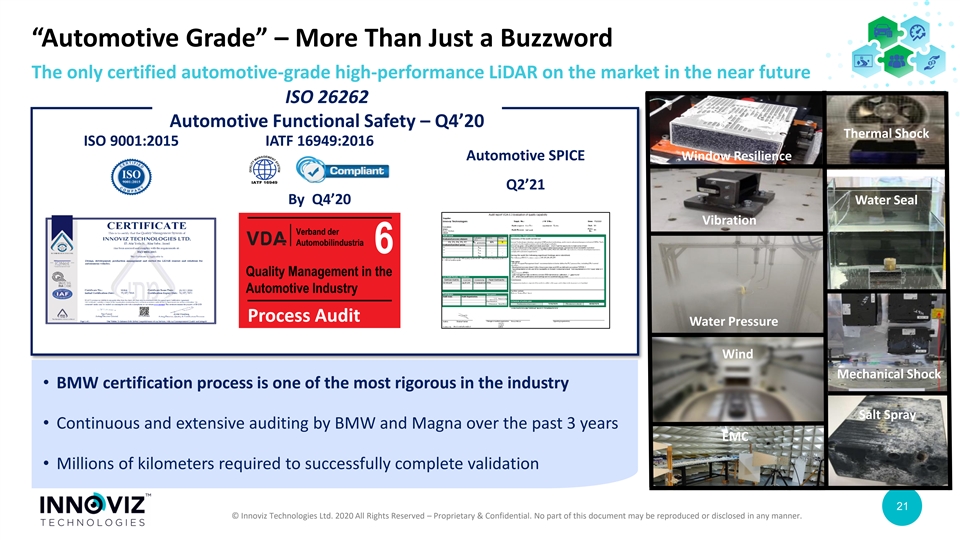

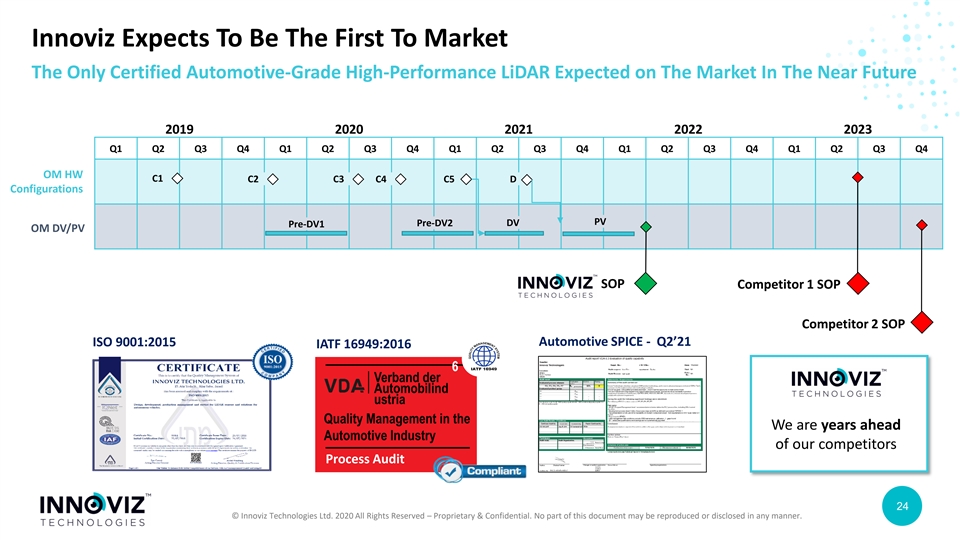

“Automotive Grade” – More Than Just a Buzzword The only certified automotive-grade high-performance LiDAR on the market in the near future ISO 26262 Automotive Functional Safety – Q4’20 Thermal Shock ISO 9001:2015 IATF 16949:2016 Automotive SPICE Window Resilience Q2’21 By Q4’20 Water Seal Vibration Verband der Automobilindustria 6 Quality Management in the Automotive Industry Process Audit Water Pressure Wind Mechanical Shock • BMW certification process is one of the most rigorous in the industry Salt Spray • Continuous and extensive auditing by BMW and Magna over the past 3 years EMC • Millions of kilometers required to successfully complete validation 21 21 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.“Automotive Grade” – More Than Just a Buzzword The only certified automotive-grade high-performance LiDAR on the market in the near future ISO 26262 Automotive Functional Safety – Q4’20 Thermal Shock ISO 9001:2015 IATF 16949:2016 Automotive SPICE Window Resilience Q2’21 By Q4’20 Water Seal Vibration Verband der Automobilindustria 6 Quality Management in the Automotive Industry Process Audit Water Pressure Wind Mechanical Shock • BMW certification process is one of the most rigorous in the industry Salt Spray • Continuous and extensive auditing by BMW and Magna over the past 3 years EMC • Millions of kilometers required to successfully complete validation 21 21 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

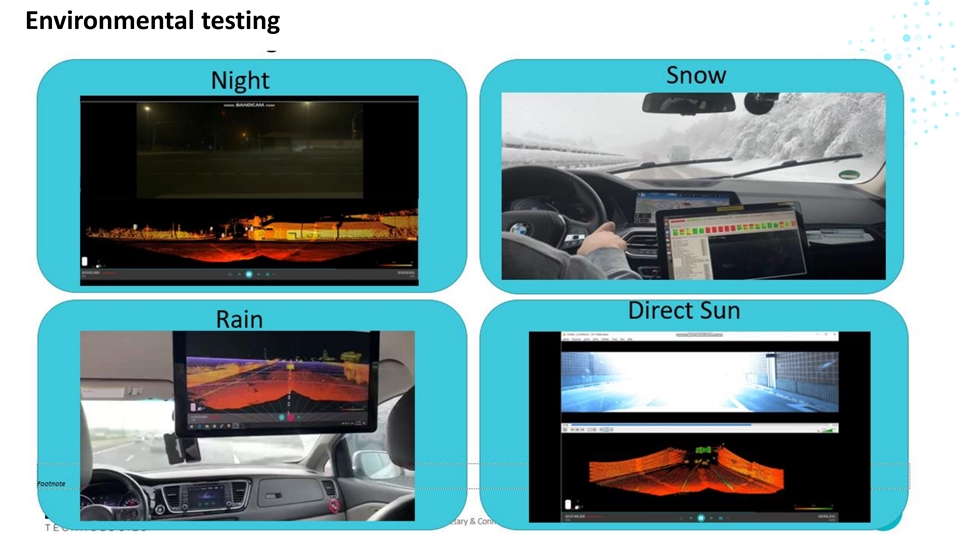

Environmental testing 22 22 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Environmental testing 22 22 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Full automation of the entire Supply chain 23 23 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Full automation of the entire Supply chain 23 23 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Innoviz Expects To Be The First To Market The Only Certified Automotive-Grade High-Performance LiDAR Expected on The Market In The Near Future 2019 2020 2021 2022 2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 OM HW C1 C2 C3 C4 C5 D Configurations PV Pre-DV2 DV Pre-DV1 OM DV/PV SOP Competitor 1 SOP Competitor 2 SOP ISO 9001:2015 Automotive SPICE - Q2’21 IATF 16949:2016 6 Verband der Automobilind ustria Quality Management in the We are years ahead Automotive Industry of our competitors Process Audit 24 24 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Expects To Be The First To Market The Only Certified Automotive-Grade High-Performance LiDAR Expected on The Market In The Near Future 2019 2020 2021 2022 2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 OM HW C1 C2 C3 C4 C5 D Configurations PV Pre-DV2 DV Pre-DV1 OM DV/PV SOP Competitor 1 SOP Competitor 2 SOP ISO 9001:2015 Automotive SPICE - Q2’21 IATF 16949:2016 6 Verband der Automobilind ustria Quality Management in the We are years ahead Automotive Industry of our competitors Process Audit 24 24 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 25 25 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 25 25 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

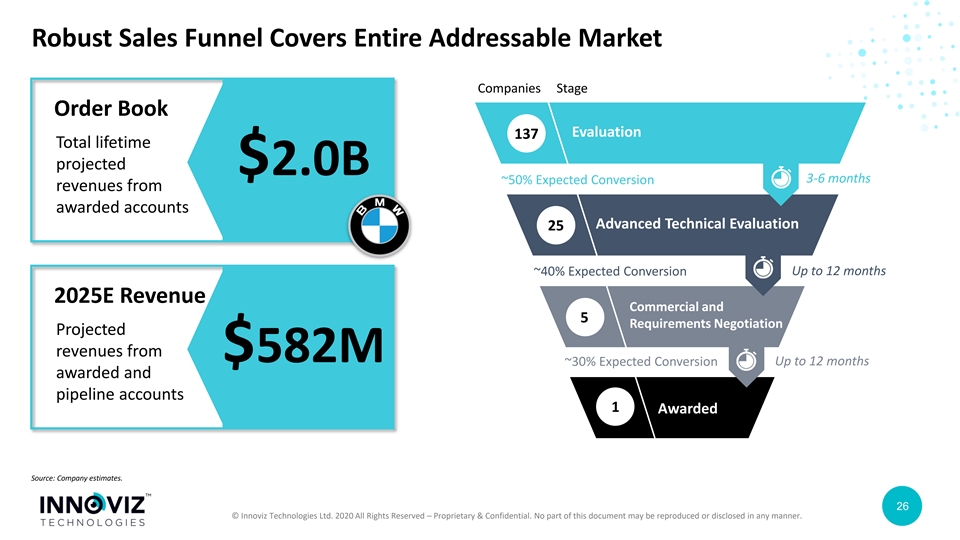

Robust Sales Funnel Covers Entire Addressable Market Companies Stage Order Book Evaluation 137 Total lifetime projected $2.0B 3-6 months ~50% Expected Conversion revenues from awarded accounts Advanced Technical Evaluation 25 Up to 12 months ~40% Expected Conversion 2025E Revenue Commercial and 5 Requirements Negotiation Projected revenues from $582M Up to 12 months ~30% Expected Conversion awarded and pipeline accounts 1 Awarded Source: Company estimates. 26 26 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Robust Sales Funnel Covers Entire Addressable Market Companies Stage Order Book Evaluation 137 Total lifetime projected $2.0B 3-6 months ~50% Expected Conversion revenues from awarded accounts Advanced Technical Evaluation 25 Up to 12 months ~40% Expected Conversion 2025E Revenue Commercial and 5 Requirements Negotiation Projected revenues from $582M Up to 12 months ~30% Expected Conversion awarded and pipeline accounts 1 Awarded Source: Company estimates. 26 26 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

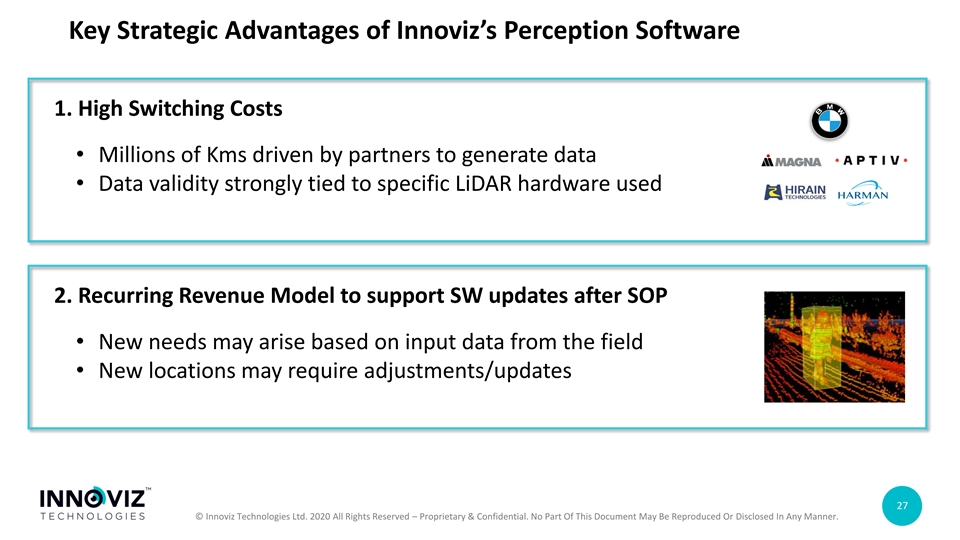

Key Strategic Advantages of Innoviz’s Perception Software 1. High Switching Costs • Millions of Kms driven by partners to generate data • Data validity strongly tied to specific LiDAR hardware used 2. Recurring Revenue Model to support SW updates after SOP • New needs may arise based on input data from the field • New locations may require adjustments/updates 27 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner.Key Strategic Advantages of Innoviz’s Perception Software 1. High Switching Costs • Millions of Kms driven by partners to generate data • Data validity strongly tied to specific LiDAR hardware used 2. Recurring Revenue Model to support SW updates after SOP • New needs may arise based on input data from the field • New locations may require adjustments/updates 27 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part Of This Document May Be Reproduced Or Disclosed In Any Manner.

Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 28 28 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Investment Highlights Large and Growing TAM for LIDAR 1 Innoviz is positioned to win in LIDAR 2 Large pipeline with significant contracted order book 3 Attractive business model, margins and valuation 4 28 28 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

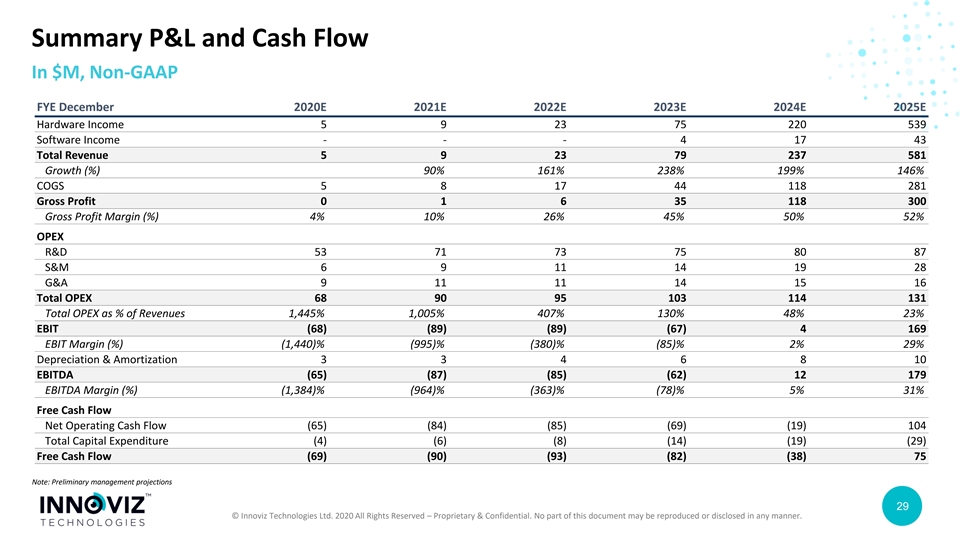

Summary P&L and Cash Flow In $M, Non-GAAP FYE December 2020E 2021E 2022E 2023E 2024E 2025E Hardware Income 5 9 23 75 220 539 Software Income - - - 4 17 43 Total Revenue 5 9 23 79 237 581 Growth (%) 90% 161% 238% 199% 146% COGS 5 8 17 44 118 281 Gross Profit 0 1 6 35 118 300 Gross Profit Margin (%) 4% 10% 26% 45% 50% 52% OPEX R&D 53 71 73 75 80 87 S&M 6 9 11 14 19 28 G&A 9 11 11 14 15 16 Total OPEX 68 90 95 103 114 131 Total OPEX as % of Revenues 1,445% 1,005% 407% 130% 48% 23% EBIT (68) (89) (89) (67) 4 169 EBIT Margin (%) (1,440)% (995)% (380)% (85)% 2% 29% Depreciation & Amortization 3 3 4 6 8 10 EBITDA (65) (87) (85) (62) 12 179 EBITDA Margin (%) (1,384)% (964)% (363)% (78)% 5% 31% Free Cash Flow Net Operating Cash Flow (65) (84) (85) (69) (19) 104 Total Capital Expenditure (4) (6) (8) (14) (19) (29) Free Cash Flow (69) (90) (93) (82) (38) 75 Note: Preliminary management projections 29 29 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Summary P&L and Cash Flow In $M, Non-GAAP FYE December 2020E 2021E 2022E 2023E 2024E 2025E Hardware Income 5 9 23 75 220 539 Software Income - - - 4 17 43 Total Revenue 5 9 23 79 237 581 Growth (%) 90% 161% 238% 199% 146% COGS 5 8 17 44 118 281 Gross Profit 0 1 6 35 118 300 Gross Profit Margin (%) 4% 10% 26% 45% 50% 52% OPEX R&D 53 71 73 75 80 87 S&M 6 9 11 14 19 28 G&A 9 11 11 14 15 16 Total OPEX 68 90 95 103 114 131 Total OPEX as % of Revenues 1,445% 1,005% 407% 130% 48% 23% EBIT (68) (89) (89) (67) 4 169 EBIT Margin (%) (1,440)% (995)% (380)% (85)% 2% 29% Depreciation & Amortization 3 3 4 6 8 10 EBITDA (65) (87) (85) (62) 12 179 EBITDA Margin (%) (1,384)% (964)% (363)% (78)% 5% 31% Free Cash Flow Net Operating Cash Flow (65) (84) (85) (69) (19) 104 Total Capital Expenditure (4) (6) (8) (14) (19) (29) Free Cash Flow (69) (90) (93) (82) (38) 75 Note: Preliminary management projections 29 29 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

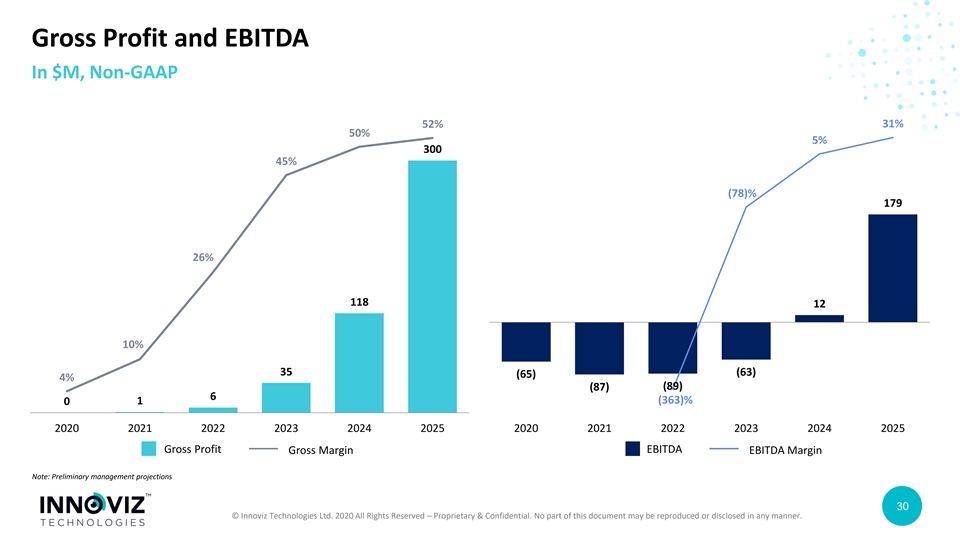

Gross Profit and EBITDA In $M, Non-GAAP 31% 52% 50% 5% 300 45% (78)% 179 26% 118 12 10% 35 (63) (65) 4% (89) (87) 6 1 (363)% 0 2020 2021 2022 2023 2024 2025 2020 2021 2022 2023 2024 2025 Gross Profit EBITDA Gross Margin EBITDA Margin Note: Preliminary management projections 30 30 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Gross Profit and EBITDA In $M, Non-GAAP 31% 52% 50% 5% 300 45% (78)% 179 26% 118 12 10% 35 (63) (65) 4% (89) (87) 6 1 (363)% 0 2020 2021 2022 2023 2024 2025 2020 2021 2022 2023 2024 2025 Gross Profit EBITDA Gross Margin EBITDA Margin Note: Preliminary management projections 30 30 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

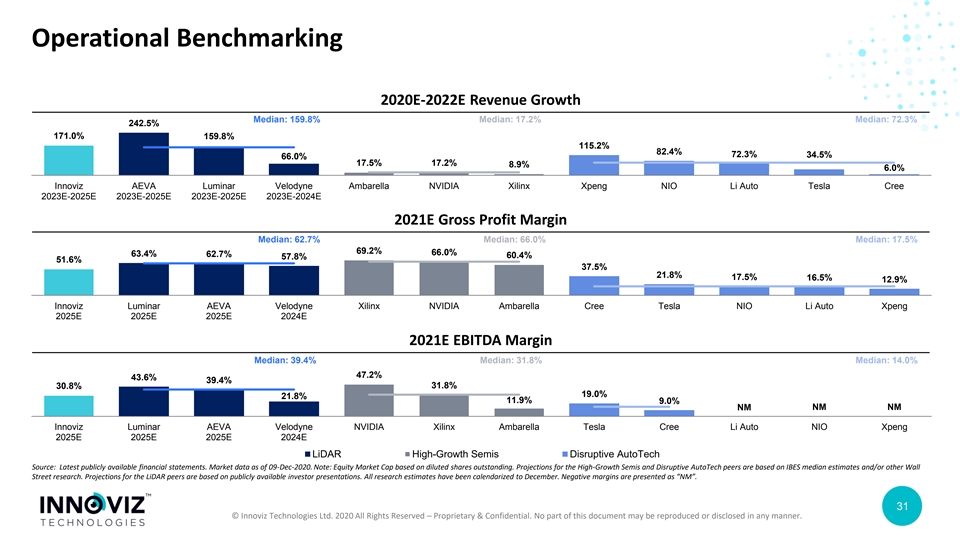

Operational Benchmarking 2020E-2022E Revenue Growth Median: 159.8% Median: 17.2% Median: 72.3% 242.5% 171.0% 159.8% 115.2% 82.4% 72.3% 34.5% 66.0% 17.5% 17.2% 8.9% 6.0% Innoviz AEVA Luminar Velodyne Ambarella NVIDIA Xilinx Xpeng NIO Li Auto Tesla Cree 2023E-2025E 2023E-2025E 2023E-2025E 2023E-2024E 2021E Gross Profit Margin Median: 62.7% Median: 66.0% Median: 17.5% 69.2% 66.0% 63.4% 62.7% 60.4% 57.8% 51.6% 37.5% 21.8% 17.5% 16.5% 12.9% Innoviz Luminar AEVA Velodyne Xilinx NVIDIA Ambarella Cree Tesla NIO Li Auto Xpeng 2025E 2025E 2025E 2024E 2021E EBITDA Margin Median: 39.4% Median: 31.8% Median: 14.0% 47.2% 43.6% 39.4% 31.8% 30.8% 19.0% 21.8% 11.9% 9.0% NM NM NM Innoviz Luminar AEVA Velodyne NVIDIA Xilinx Ambarella Tesla Cree Li Auto NIO Xpeng 2025E 2025E 2025E 2024E LiDAR High-Growth Semis Disruptive AutoTech Source: Latest publicly available financial statements. Market data as of 09-Dec-2020. Note: Equity Market Cap based on diluted shares outstanding. Projections for the High-Growth Semis and Disruptive AutoTech peers are based on IBES median estimates and/or other Wall Street research. Projections for the LiDAR peers are based on publicly available investor presentations. All research estimates have been calendarized to December. Negative margins are presented as “NM”. 31 31 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Operational Benchmarking 2020E-2022E Revenue Growth Median: 159.8% Median: 17.2% Median: 72.3% 242.5% 171.0% 159.8% 115.2% 82.4% 72.3% 34.5% 66.0% 17.5% 17.2% 8.9% 6.0% Innoviz AEVA Luminar Velodyne Ambarella NVIDIA Xilinx Xpeng NIO Li Auto Tesla Cree 2023E-2025E 2023E-2025E 2023E-2025E 2023E-2024E 2021E Gross Profit Margin Median: 62.7% Median: 66.0% Median: 17.5% 69.2% 66.0% 63.4% 62.7% 60.4% 57.8% 51.6% 37.5% 21.8% 17.5% 16.5% 12.9% Innoviz Luminar AEVA Velodyne Xilinx NVIDIA Ambarella Cree Tesla NIO Li Auto Xpeng 2025E 2025E 2025E 2024E 2021E EBITDA Margin Median: 39.4% Median: 31.8% Median: 14.0% 47.2% 43.6% 39.4% 31.8% 30.8% 19.0% 21.8% 11.9% 9.0% NM NM NM Innoviz Luminar AEVA Velodyne NVIDIA Xilinx Ambarella Tesla Cree Li Auto NIO Xpeng 2025E 2025E 2025E 2024E LiDAR High-Growth Semis Disruptive AutoTech Source: Latest publicly available financial statements. Market data as of 09-Dec-2020. Note: Equity Market Cap based on diluted shares outstanding. Projections for the High-Growth Semis and Disruptive AutoTech peers are based on IBES median estimates and/or other Wall Street research. Projections for the LiDAR peers are based on publicly available investor presentations. All research estimates have been calendarized to December. Negative margins are presented as “NM”. 31 31 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

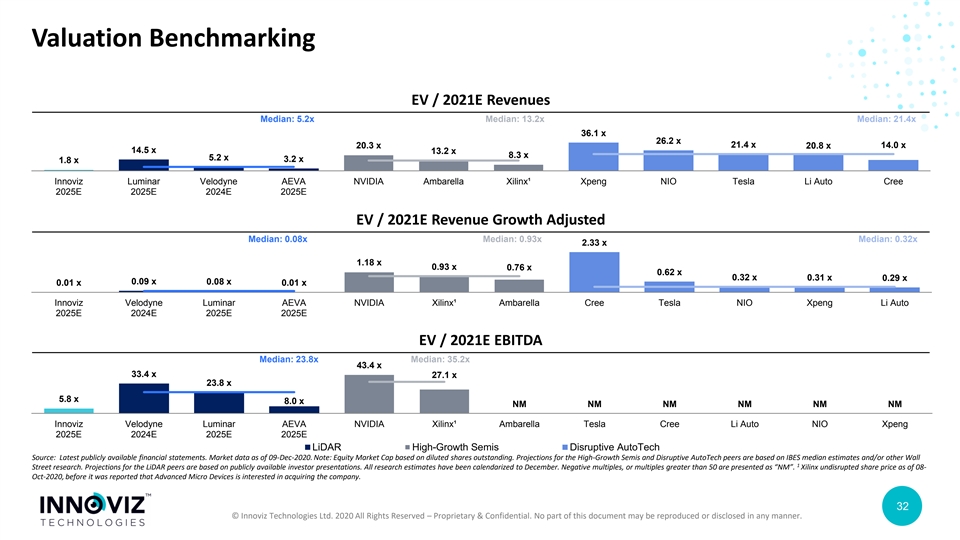

Valuation Benchmarking EV / 2021E Revenues Median: 5.2x Median: 13.2x Median: 21.4x 36.1 x 26.2 x 21.4 x 14.0 x 20.3 x 20.8 x 14.5 x 13.2 x 8.3 x 5.2 x 3.2 x 1.8 x Innoviz Luminar Velodyne AEVA NVIDIA Ambarella Xilinx¹ Xpeng NIO Tesla Li Auto Cree 2025E 2025E 2024E 2025E EV / 2021E Revenue Growth Adjusted Median: 0.08x Median: 0.93x Median: 0.32x 2.33 x 1.18 x 0.93 x 0.76 x 0.62 x 0.32 x 0.31 x 0.29 x 0.09 x 0.08 x 0.01 x 0.01 x Innoviz Velodyne Luminar AEVA NVIDIA Xilinx¹ Ambarella Cree Tesla NIO Xpeng Li Auto 2025E 2024E 2025E 2025E EV / 2021E EBITDA Median: 23.8x Median: 35.2x 43.4 x 33.4 x 27.1 x 23.8 x 5.8 x 8.0 x NM NM NM NM NM NM Innoviz Velodyne Luminar AEVA NVIDIA Xilinx¹ Ambarella Tesla Cree Li Auto NIO Xpeng 2025E 2024E 2025E 2025E LiDAR High-Growth Semis Disruptive AutoTech Source: Latest publicly available financial statements. Market data as of 09-Dec-2020. Note: Equity Market Cap based on diluted shares outstanding. Projections for the High-Growth Semis and Disruptive AutoTech peers are based on IBES median estimates and/or other Wall 1 Street research. Projections for the LiDAR peers are based on publicly available investor presentations. All research estimates have been calendarized to December. Negative multiples, or multiples greater than 50 are presented as “NM”. Xilinx undisrupted share price as of 08- Oct-2020, before it was reported that Advanced Micro Devices is interested in acquiring the company. 32 32 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Valuation Benchmarking EV / 2021E Revenues Median: 5.2x Median: 13.2x Median: 21.4x 36.1 x 26.2 x 21.4 x 14.0 x 20.3 x 20.8 x 14.5 x 13.2 x 8.3 x 5.2 x 3.2 x 1.8 x Innoviz Luminar Velodyne AEVA NVIDIA Ambarella Xilinx¹ Xpeng NIO Tesla Li Auto Cree 2025E 2025E 2024E 2025E EV / 2021E Revenue Growth Adjusted Median: 0.08x Median: 0.93x Median: 0.32x 2.33 x 1.18 x 0.93 x 0.76 x 0.62 x 0.32 x 0.31 x 0.29 x 0.09 x 0.08 x 0.01 x 0.01 x Innoviz Velodyne Luminar AEVA NVIDIA Xilinx¹ Ambarella Cree Tesla NIO Xpeng Li Auto 2025E 2024E 2025E 2025E EV / 2021E EBITDA Median: 23.8x Median: 35.2x 43.4 x 33.4 x 27.1 x 23.8 x 5.8 x 8.0 x NM NM NM NM NM NM Innoviz Velodyne Luminar AEVA NVIDIA Xilinx¹ Ambarella Tesla Cree Li Auto NIO Xpeng 2025E 2024E 2025E 2025E LiDAR High-Growth Semis Disruptive AutoTech Source: Latest publicly available financial statements. Market data as of 09-Dec-2020. Note: Equity Market Cap based on diluted shares outstanding. Projections for the High-Growth Semis and Disruptive AutoTech peers are based on IBES median estimates and/or other Wall 1 Street research. Projections for the LiDAR peers are based on publicly available investor presentations. All research estimates have been calendarized to December. Negative multiples, or multiples greater than 50 are presented as “NM”. Xilinx undisrupted share price as of 08- Oct-2020, before it was reported that Advanced Micro Devices is interested in acquiring the company. 32 32 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

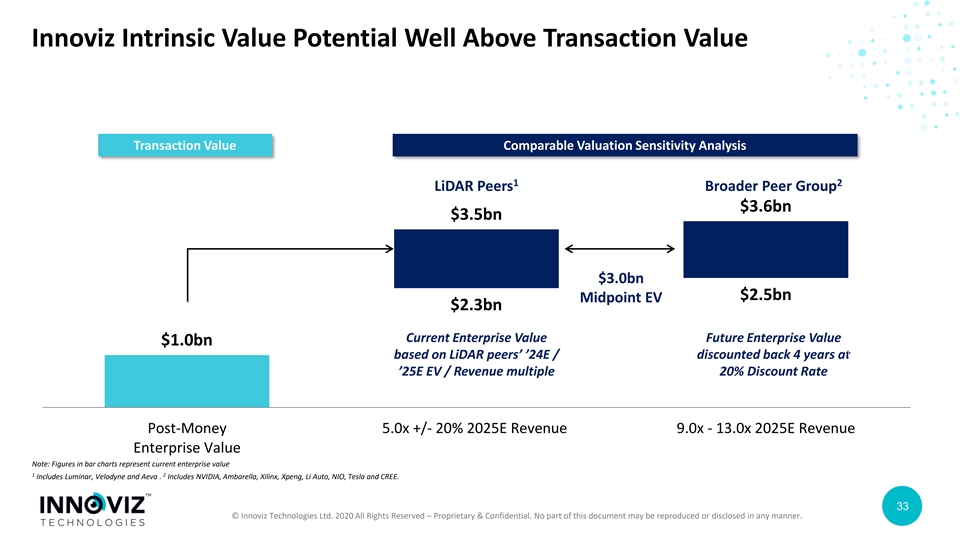

Innoviz Intrinsic Value Potential Well Above Transaction Value Transaction Value Comparable Valuation Sensitivity Analysis 1 2 LiDAR Peers Broader Peer Group $3.6bn $3.5bn $3.0bn $2.5bn Midpoint EV $2.3bn Current Enterprise Value Future Enterprise Value $1.0bn based on LiDAR peers’ ’24E / discounted back 4 years at 1.8x 2025E Revenue ’25E EV / Revenue multiple 20% Discount Rate Post-Money 5.0x +/- 20% 2025E Revenue 9.0x - 13.0x 2025E Revenue Enterprise Value Note: Figures in bar charts represent current enterprise value 1 2 Includes Luminar, Velodyne and Aeva . Includes NVIDIA, Ambarella, Xilinx, Xpeng, Li Auto, NIO, Tesla and CREE. 33 33 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Intrinsic Value Potential Well Above Transaction Value Transaction Value Comparable Valuation Sensitivity Analysis 1 2 LiDAR Peers Broader Peer Group $3.6bn $3.5bn $3.0bn $2.5bn Midpoint EV $2.3bn Current Enterprise Value Future Enterprise Value $1.0bn based on LiDAR peers’ ’24E / discounted back 4 years at 1.8x 2025E Revenue ’25E EV / Revenue multiple 20% Discount Rate Post-Money 5.0x +/- 20% 2025E Revenue 9.0x - 13.0x 2025E Revenue Enterprise Value Note: Figures in bar charts represent current enterprise value 1 2 Includes Luminar, Velodyne and Aeva . Includes NVIDIA, Ambarella, Xilinx, Xpeng, Li Auto, NIO, Tesla and CREE. 33 33 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

Thank You 34 34 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Thank You 34 34 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.

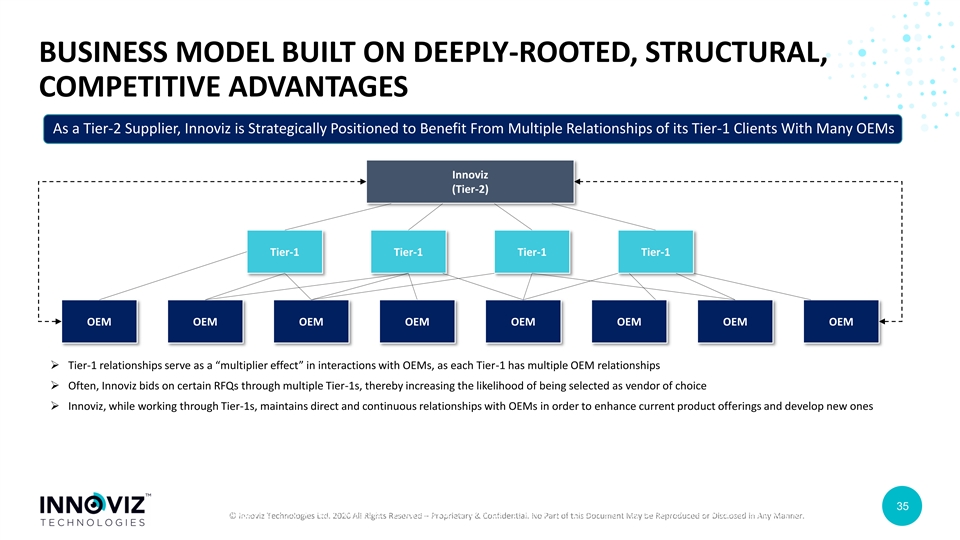

BUSINESS MODEL BUILT ON DEEPLY-ROOTED, STRUCTURAL, COMPETITIVE ADVANTAGES As a Tier-2 Supplier, Innoviz is Strategically Positioned to Benefit From Multiple Relationships of its Tier-1 Clients With Many OEMs Innoviz (Tier-2) Tier-1 Tier-1 Tier-1 Tier-1 OEM OEM OEM OEM OEM OEM OEM OEM ➢ Tier-1 relationships serve as a “multiplier effect” in interactions with OEMs, as each Tier-1 has multiple OEM relationships ➢ Often, Innoviz bids on certain RFQs through multiple Tier-1s, thereby increasing the likelihood of being selected as vendor of choice ➢ Innoviz, while working through Tier-1s, maintains direct and continuous relationships with OEMs in order to enhance current product offerings and develop new ones 35 © Innoviz Technologies Ltd. 2018 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner 35 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.BUSINESS MODEL BUILT ON DEEPLY-ROOTED, STRUCTURAL, COMPETITIVE ADVANTAGES As a Tier-2 Supplier, Innoviz is Strategically Positioned to Benefit From Multiple Relationships of its Tier-1 Clients With Many OEMs Innoviz (Tier-2) Tier-1 Tier-1 Tier-1 Tier-1 OEM OEM OEM OEM OEM OEM OEM OEM ➢ Tier-1 relationships serve as a “multiplier effect” in interactions with OEMs, as each Tier-1 has multiple OEM relationships ➢ Often, Innoviz bids on certain RFQs through multiple Tier-1s, thereby increasing the likelihood of being selected as vendor of choice ➢ Innoviz, while working through Tier-1s, maintains direct and continuous relationships with OEMs in order to enhance current product offerings and develop new ones 35 © Innoviz Technologies Ltd. 2018 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner 35 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.

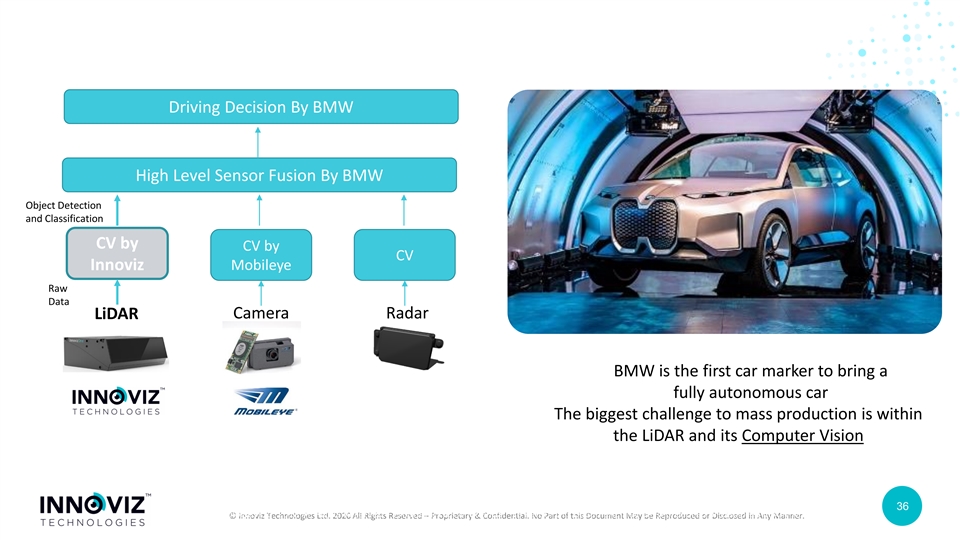

Driving Decision By BMW High Level Sensor Fusion By BMW Object Detection and Classification CV by CV by CV Innoviz Mobileye Raw Data LiDAR Camera Radar BMW is the first car marker to bring a fully autonomous car The biggest challenge to mass production is within the LiDAR and its Computer Vision 36 © Innoviz Technologies Ltd. 2018 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner 36 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.Driving Decision By BMW High Level Sensor Fusion By BMW Object Detection and Classification CV by CV by CV Innoviz Mobileye Raw Data LiDAR Camera Radar BMW is the first car marker to bring a fully autonomous car The biggest challenge to mass production is within the LiDAR and its Computer Vision 36 © Innoviz Technologies Ltd. 2018 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner 36 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.

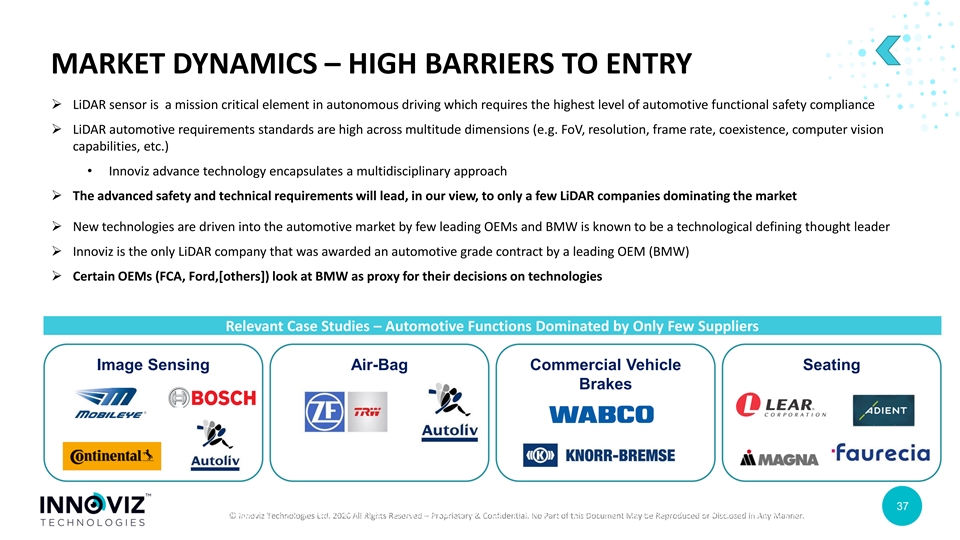

MARKET DYNAMICS – HIGH BARRIERS TO ENTRY ➢ LiDAR sensor is a mission critical element in autonomous driving which requires the highest level of automotive functional safety compliance ➢ LiDAR automotive requirements standards are high across multitude dimensions (e.g. FoV, resolution, frame rate, coexistence, computer vision capabilities, etc.) • Innoviz advance technology encapsulates a multidisciplinary approach ➢ The advanced safety and technical requirements will lead, in our view, to only a few LiDAR companies dominating the market ➢ New technologies are driven into the automotive market by few leading OEMs and BMW is known to be a technological defining thought leader ➢ Innoviz is the only LiDAR company that was awarded an automotive grade contract by a leading OEM (BMW) ➢ Certain OEMs (FCA, Ford,[others]) look at BMW as proxy for their decisions on technologies Relevant Case Studies – Automotive Functions Dominated by Only Few Suppliers Image Sensing Air-Bag Commercial Vehicle Seating Brakes 37 © Innoviz Technologies Ltd. 2018 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner 37 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.MARKET DYNAMICS – HIGH BARRIERS TO ENTRY ➢ LiDAR sensor is a mission critical element in autonomous driving which requires the highest level of automotive functional safety compliance ➢ LiDAR automotive requirements standards are high across multitude dimensions (e.g. FoV, resolution, frame rate, coexistence, computer vision capabilities, etc.) • Innoviz advance technology encapsulates a multidisciplinary approach ➢ The advanced safety and technical requirements will lead, in our view, to only a few LiDAR companies dominating the market ➢ New technologies are driven into the automotive market by few leading OEMs and BMW is known to be a technological defining thought leader ➢ Innoviz is the only LiDAR company that was awarded an automotive grade contract by a leading OEM (BMW) ➢ Certain OEMs (FCA, Ford,[others]) look at BMW as proxy for their decisions on technologies Relevant Case Studies – Automotive Functions Dominated by Only Few Suppliers Image Sensing Air-Bag Commercial Vehicle Seating Brakes 37 © Innoviz Technologies Ltd. 2018 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner 37 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No Part of this Document May be Reproduced or Disclosed in Any Manner.

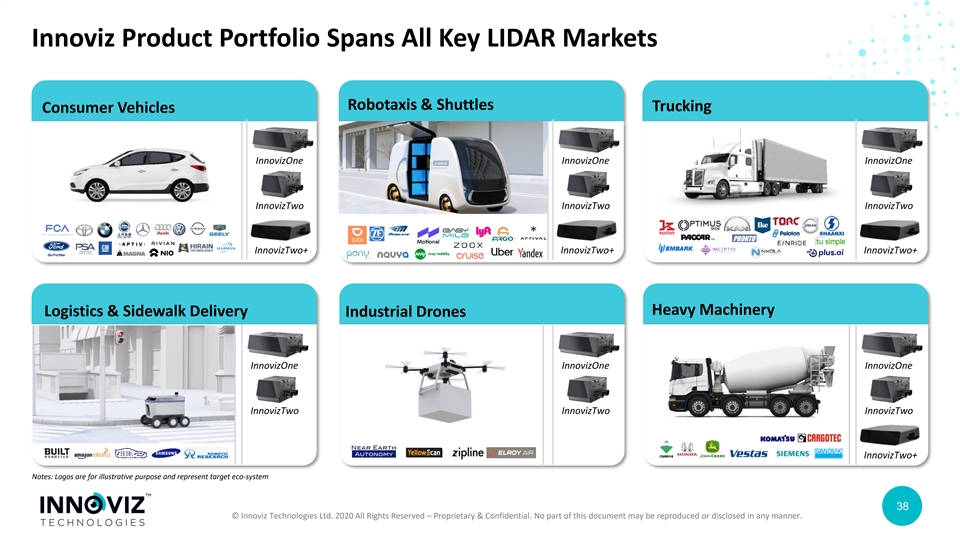

Innoviz Product Portfolio Spans All Key LIDAR Markets Robotaxis & Shuttles Trucking Consumer Vehicles InnovizOne InnovizOne InnovizOne InnovizTwo InnovizTwo InnovizTwo InnovizTwo+ InnovizTwo+ InnovizTwo+ Heavy Machinery Logistics & Sidewalk Delivery Industrial Drones InnovizOne InnovizOne InnovizOne InnovizTwo InnovizTwo InnovizTwo InnovizTwo+ Notes: Logos are for illustrative purpose and represent target eco-system 38 38 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.Innoviz Product Portfolio Spans All Key LIDAR Markets Robotaxis & Shuttles Trucking Consumer Vehicles InnovizOne InnovizOne InnovizOne InnovizTwo InnovizTwo InnovizTwo InnovizTwo+ InnovizTwo+ InnovizTwo+ Heavy Machinery Logistics & Sidewalk Delivery Industrial Drones InnovizOne InnovizOne InnovizOne InnovizTwo InnovizTwo InnovizTwo InnovizTwo+ Notes: Logos are for illustrative purpose and represent target eco-system 38 38 © Innoviz Technologies Ltd. 2020 All Rights Reserved – Proprietary & Confidential. No part of this document may be reproduced or disclosed in any manner.